The global employee benefit broker market is undergoing transformative expansion, projected to surge from USD 48.24 billion in 2025 to surpass USD 78 billion by 2034, as highlighted by Precedence Research. This growth is fueled not only by rapid technological advancements, including AI, but also by an escalating demand for smarter, more adaptable employee benefit solutions that address diverse workforce needs.

Brokerages and ultimately, consultants are under unprecedented pressure to deliver greater value with agility and speed. Leveraging next-gen InsurTech has become a vital strategy, not only to meet accelerating market demands but also to scale operations rapidly and sustainably.

New Technology Is Reshaping Employee Benefits

Employee benefit brokers often spend their time on administrative backend and compliance tasks. After attending several InsurTech events this year, it has become clear that technology’s rapid advancement is poised to transform how brokers and consultants operate. We often probe Brokerages on fundamental questions that arise before adopting new solutions:

- What are the biggest bottlenecks or time drains in your current benefits administration and client support processes?

- Which manual or repetitive tasks consume the most broker or consultant time that could be automated?

- How well are you currently leveraging data analytics to understand client needs and uncover new revenue opportunities?

- What compliance risks or challenges do you face regularly that technology could help manage or reduce?

- How is your employee benefit support experience perceived by clients and plan participants? Where are the gaps?

- Which parts of your technology stack (CRM, admin platforms, communication tools) need integration or upgrading first?

- Will the company fall behind if you don’t adopt AI-driven platforms?

- How will you measure success and ROI from implementing new InsurTech solutions?

- Which InsurTech features align best with the types of benefits plans and client segments you serve?

These reflective questions have guided Eppione’s Co-Founders, David Kindlon, Neil Fallon, and Ernest Legrand, as they pioneered disruptive technology in employee benefits. This introspection led to the creation of Eppione’s BrokerAI and helps brokerages transform their mindset.

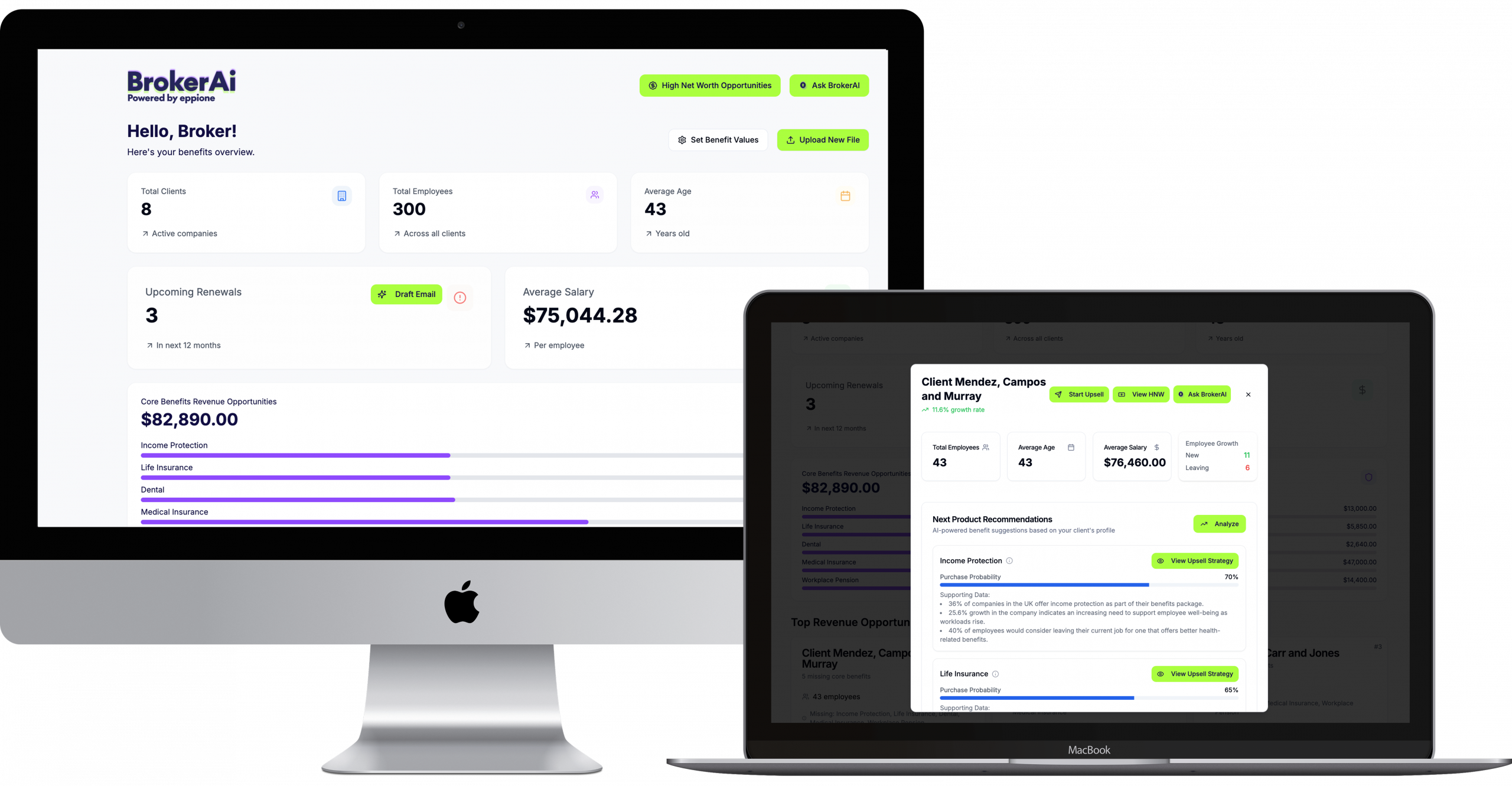

Meet Eppione’s BrokerAI: Elevating Employee Benefits Management

BrokerAI is designed to eliminate the burden of back-office admin and repetitive manual tasks through intelligent automation. Built atop the next-generation Eppione platform, it integrates seamlessly with your CRM, harnessing client data to deliver real-time insights. Features such as High Net Worth (HNW) opportunity detection, renewal tracking and alerts, and AI-driven analysis provide significant value to your business and clients alike. Automating enrollment, communication, and email workflows is just the beginning; Eppione empowers brokers with predictive analytics, personalized recommendations, and actionable real-time business intelligence.

Failing to adopt cutting-edge technology today puts brokers at risk of being left behind. Our technology is built by brokers, for brokers; it understands your challenges and is designed to help you compete and thrive in a digitally transformed industry. It automates routine client communications and delivers AI-driven alerts to keep you instantly informed of key portfolio changes. Real-time identification of cross-sell and upsell opportunities maximizes your revenue potential, while minimizing compliance risks lets you concentrate on growing your business.

David Kindlon, Co-Founder of Eppione, says, “BrokerAI solves your biggest pain points, empowering you to proactively serve clients, improve retention, and unlock new business opportunities—all while ensuring a secure, fully compliant environment.”

Your clients will thank you. Your business will thrive. But the question remains, can you afford to ignore this transformation?

Benefit brokers partnering with Eppione gain:

- Operational Efficiency: Automated processes reduce admin overhead, freeing broker time for high-impact advisory.

- Enhanced Client Experience: Instant, AI-driven responses to employee benefit queries improve satisfaction and retention.

- Compliance Confidence: Built-in regulatory safeguards minimize costly errors and compliance risks, protecting reputation.

- Business Growth: Real-time analytics surface opportunities for cross-selling and upselling, expanding revenue streams.

- Competitive Edge: Brokers leveraging AI and InsurTech differentiate themselves as innovative, future-ready partners in employee wellbeing.

This combination of efficiency, insight, compliance, and growth makes BrokerAI an indispensable ally for brokers navigating the complex employee benefits market.

Why InsurTech Is Crucial for Employee Benefit Brokers and Consultants

We are living in a hyper-competitive global market, accelerated by rapidly evolving workforce expectations and economic uncertainty. Adopting new technology is no longer a luxury; it’s essential for survival and growth. According to a Precedence Research analysis, the future lies in providing holistic support spanning health, retirement planning, and wellness, all powered by AI and integrated digital platforms. These tools do not merely automate tasks; they enable brokers to deliver personalized, data-backed advice that meets the increasingly sophisticated needs of global workforces.

An investment in InsurTech might seem daunting, but it’s precisely this environment where efficiency and agility matter most. The right technology reduces operational costs, enhances compliance management, improves employee engagement, and opens new avenues for revenue. For brokers, leveraging BrokerAI turns from a cost center into a powerful growth engine, equipping you to act as strategic partners rather than mere intermediaries. Embracing these technologies doesn’t just futureproof your business; it fundamentally transforms how you serve clients and scale sustainably across diverse markets.

Explore how Eppione’s BrokerAI can transform your brokerage. Book a demo today and take the first step toward future-proofing your business.